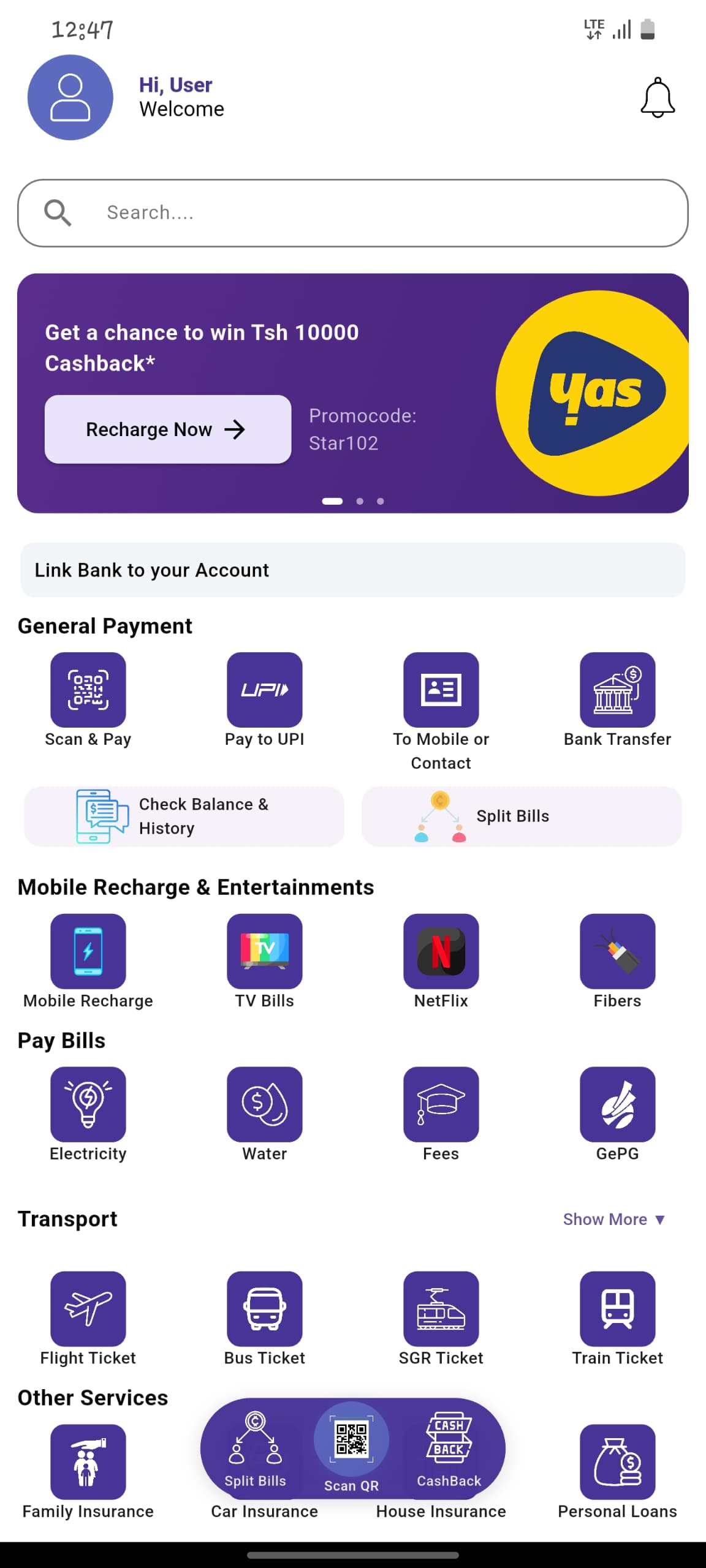

Zero-Fee Digital Payments for Tanzania

Send, receive, and manage money seamlessly across banks, mobile wallets, and businesses with no transaction fees. Join the financial revolution today.

Why Choose PixPesa?

Revolutionizing Tanzania's financial landscape with innovative solutions designed for everyone

Zero Fees

No transaction fees for payments under 3 million TZS per day, saving you hundreds of thousands annually compared to traditional mobile money.

Universal Compatibility

Works seamlessly across all banks and mobile money platforms in Tanzania, breaking down financial silos.

Bank-Grade Security

Military-grade encryption, biometric authentication, and AI fraud detection keep your money safe.

PixPesa vs. Traditional Services

Why we're the smarter choice for Tanzania

| Feature | PixPesa | Others |

|---|---|---|

| Transaction Fees | 0% (up to 3M TZS/day) | 3-7% |

| Interoperability | All banks & mobile wallets | Limited |

| Daily Limit | 3,000,000 TZS | 500,000-1,000,000 TZS |

| Security | Biometric + AI Fraud Detection | Basic PIN protection |

| Business Tools | Included (invoicing, analytics) | Extra fees apply |

Built for Tanzanian Businesses

Special tools designed for SMEs and merchants to thrive in the digital economy

Zero-Cost Payments

Accept payments without transaction fees cutting into your profits. Save up to 300,000 TZS annually compared to traditional mobile money.

Digital Invoicing

Create and track professional invoices directly in the app. Send to customers via SMS or email with payment links.

Sales Analytics

Real-time insights into your business transactions. Track daily sales, customer payments, and growth trends.

Transforming Tanzania's Financial Future

PixPesa is more than a payment app - it's a movement to bring financial freedom to all Tanzanians. Inspired by India's UPI success (processing 10B+ transactions monthly), we're adapting this proven model for Tanzania's unique needs.

With just 22% banking penetration but 76% financial service usage, PixPesa bridges the gap by offering bank-like services to everyone with a smartphone.

Our Story

Aligned with Tanzania's Vision 2025

PixPesa supports national goals for financial inclusion and digital transformation through:

- Direct support for BOT's 80% financial inclusion target by 2028

- Full compliance with AML/KYC regulations

- Integration with National Digital Economy Blueprint

- Partnerships with banks, telecoms, and fintechs

- Rural financial access initiatives (currently 55% vs urban 85%)

Ready to Experience the Future of Payments?

Join thousands of Tanzanians who are already enjoying seamless, fee-free digital transactions with PixPesa.